Our Approach

Focus on Long-Term Returns

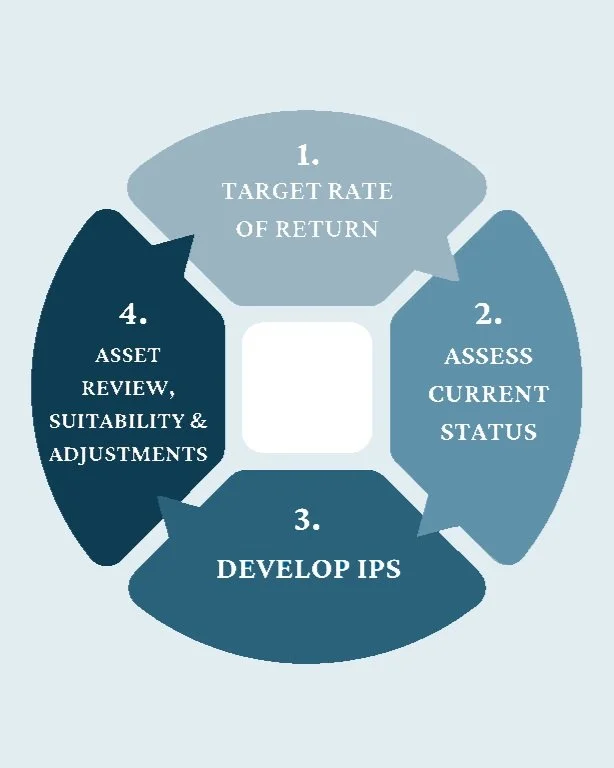

Our investment approach is rooted in academic research on how to best utilize the financial markets. Our approach can briefly be described as follows:

Choose a percentage of equity vs fixed income that matches investor’s time horizon and risk tolerance.

Tilt the equity portion of the portion of the portfolio towards small, value, and high profit companies. These categories of stocks, also known as factors, have in the past shown higher long term stock price returns.

Match the portfolio to the worldwide market. Another way to state this principle is: strategies that involve market timing and/or picking winners and losers do not beat the market; since one cannot beat the market, one should buy the market.

This approach drives down investment costs and improves long-term returns. The portfolios we build for our investors utilizing this approach will never be the year’s best or worst performing portfolios, but they will be top-tier portfolios in terms of achieving our clients' financial goals within their stated risk tolerance.

Customization

We service a broad range of investor clients. We start with the same investment philosophy across the entire spectrum, but customize our recommendations and asset allocations based on our clients’ particular characteristics and preferences, including:

Age

Place in career cycle

Goals

Portfolio size

Account type mix, such as taxable and tax-deferred retirement accounts

Retirement plan contributions and/or distributions

Income level, income composition, and tax brackets

Risk tolerance

Specific requests and concerns.